Regulatory Titans: How AGCO and Lotto-Quebec Are Changing iGaming in Canada

Recommended casinos

Across Canada, provincial governments are taking varied routes toward regulating online gambling, and nowhere is this more evident than in the contrasting strategies of Ontario and Quebec. The Alcohol and Gaming Commission of Ontario (AGCO) is pushing a modern, open-market model, while Loto-Québec maintains a centralized approach. These two regulatory giants are not only setting the tone in their respective regions but are also influencing the broader direction of Canada’s gaming industry.

The History of Canadian iGaming Regulations

Initially, all forms of gambling were federally prohibited until the 1970s, when provinces were granted authority to oversee gambling activities. This led to the rise of provincial lotteries and land-based casinos. Online gambling emerged in the late 1990s, but regulation remained fragmented. Quebec launched one of the first government-run online gambling sites, while other provinces took more cautious approaches. A major turning point came in 2022 with Ontario’s launch of a regulated open iGaming market, allowing private operators to enter under the oversight of the AGCO.

Overview of Canada’s iGaming Frameworks

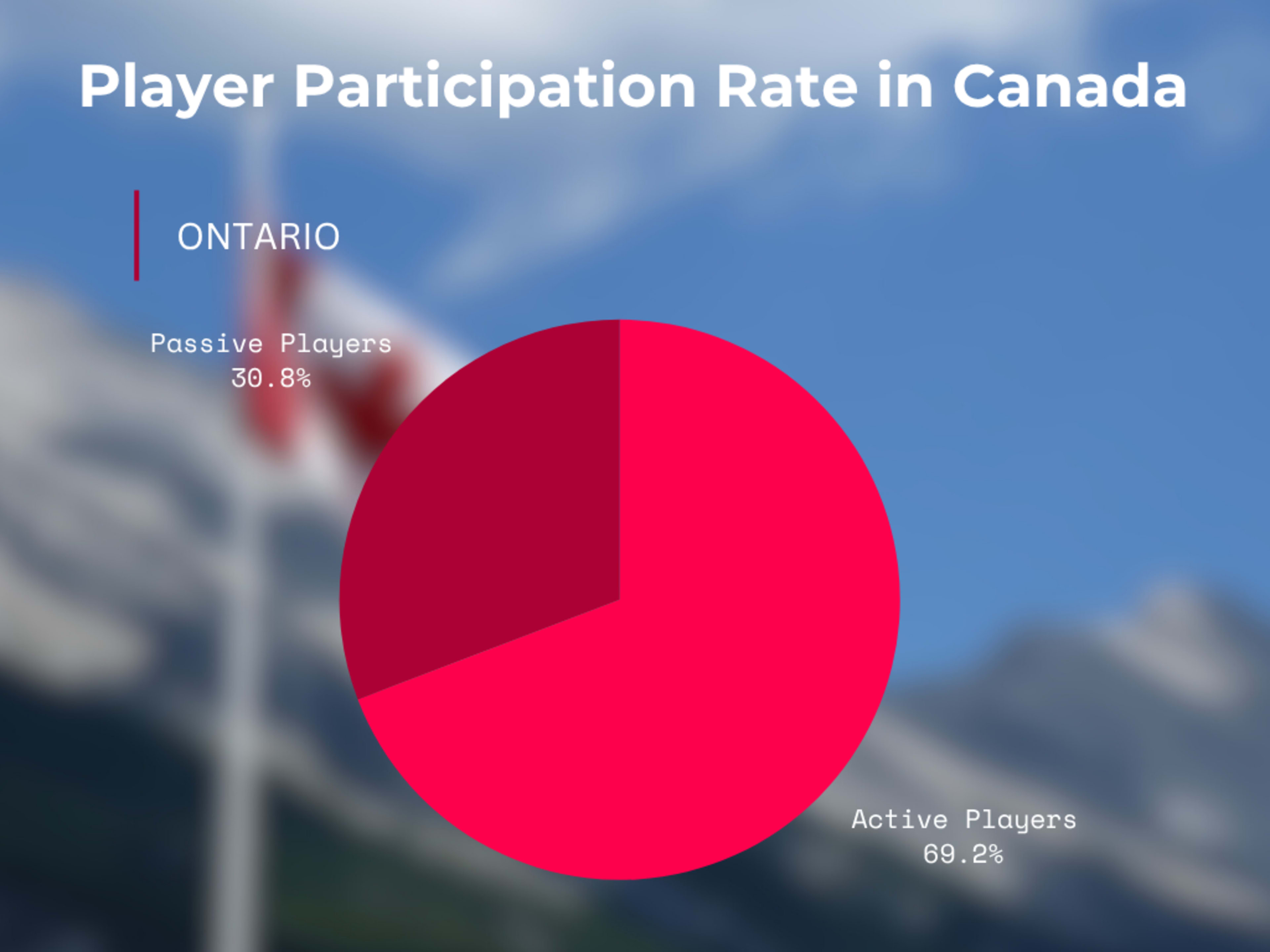

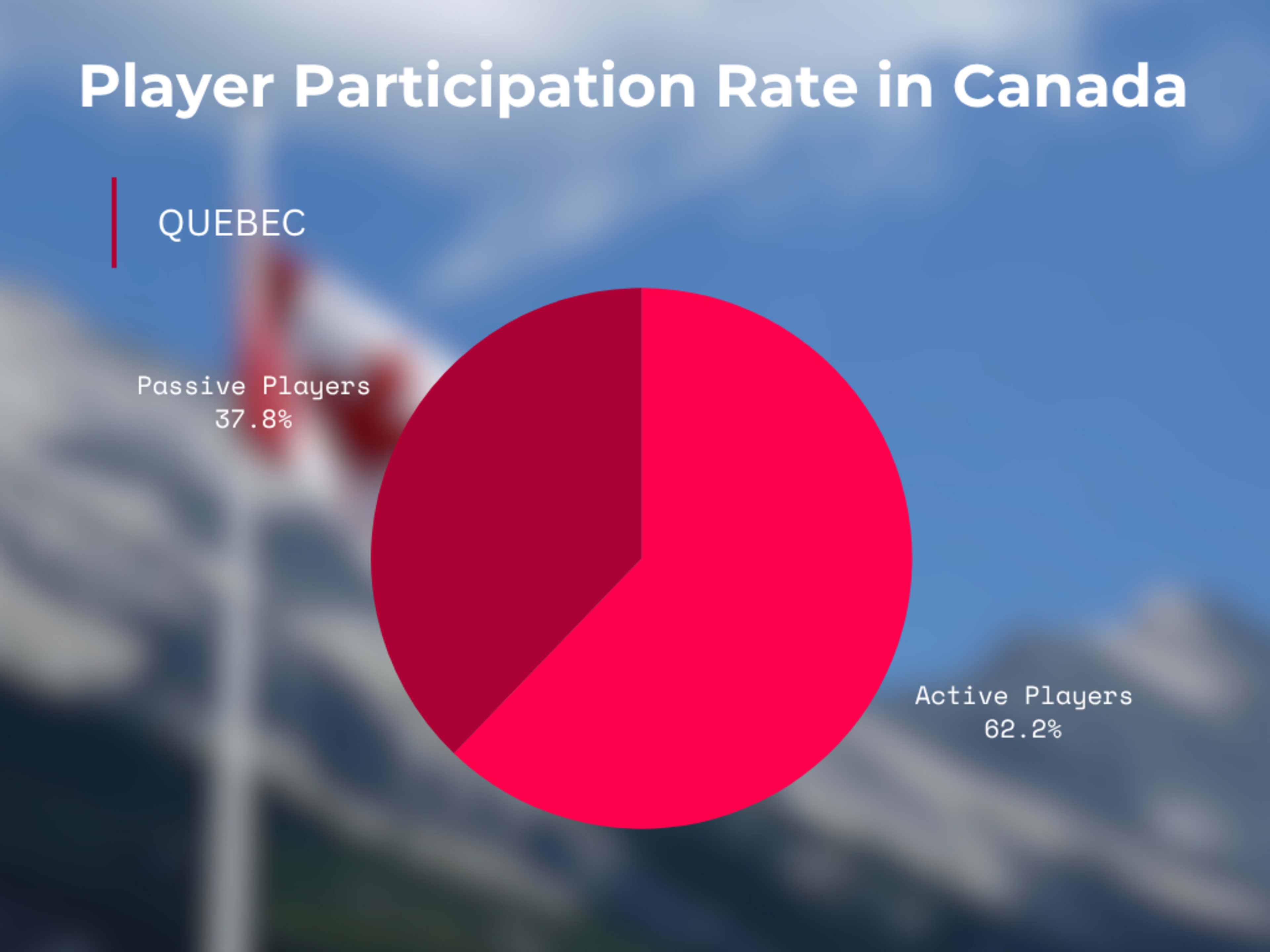

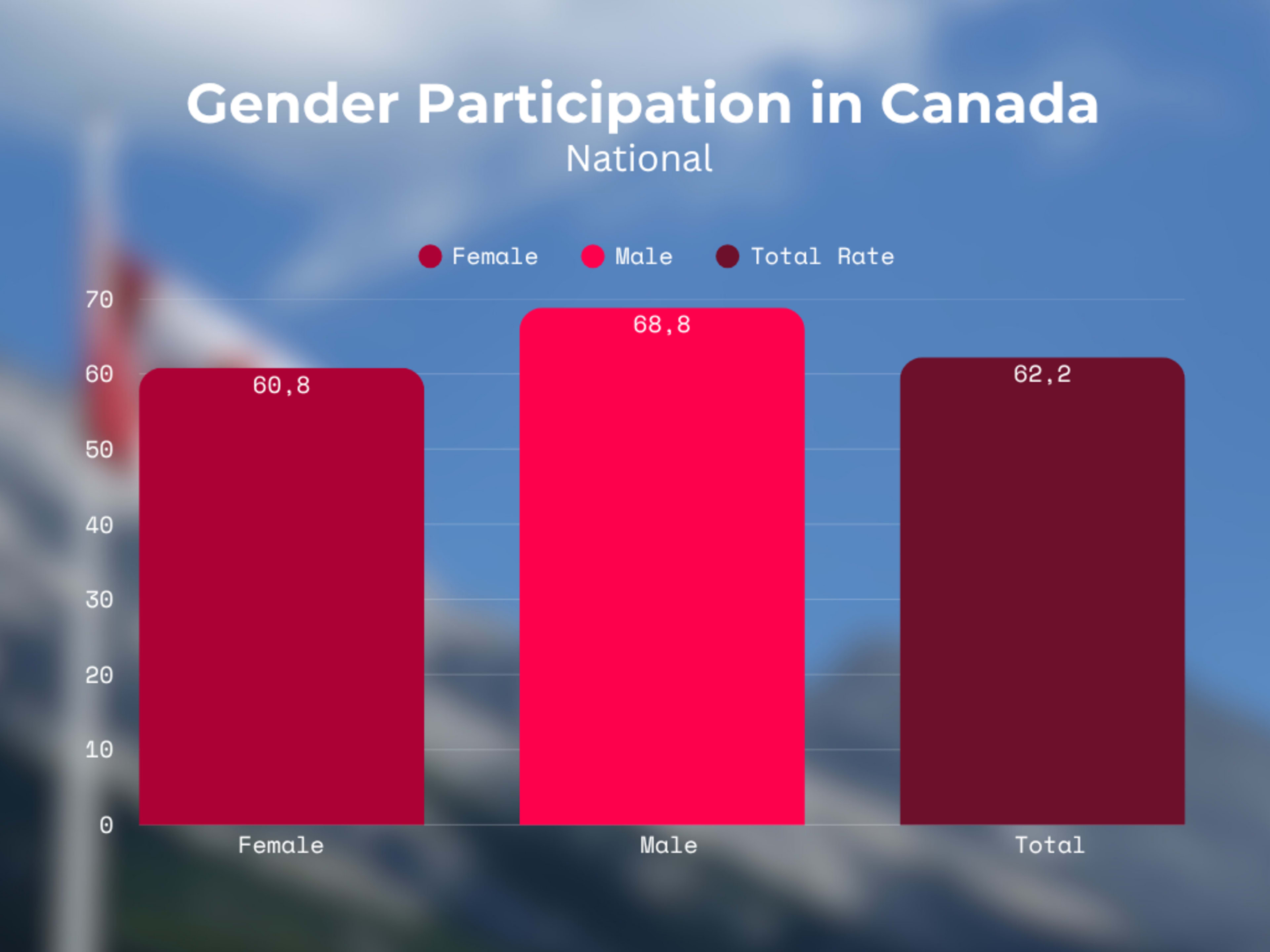

Canada's gambling regulatory framework operates under a provincial model, with each jurisdiction implementing its own approach. According to Casino Industry News, approximately 64.5% of Canadians under 24 years old participated in some form of gambling in 2024, with participation rates and Canadian player preferences varying by province.

Quebec leads with a 69.1% participation rate, while Ontario reports 62.2% - a notable difference that reflects distinct regulatory environments and cultural attitudes. Men consistently show higher participation rates across all provinces, with 68.8% nationally compared to 60.4% for women.

AGCO: Ontario Regulations

Ontario made history in April 2022 by becoming Canada's first province to establish an open, regulated iGaming market. Under this model, the AGCO serves as the primary regulatory body while iGaming Ontario (iGO) – recently separated into a distinct agency – operates as a subsidiary focused on managing operator agreements. The AGCO model features several distinctive characteristics:

- Competitive Licensing: Private operators can apply for licenses, creating a competitive marketplace with over 70 licenses issued since April 2022. This open structure has encouraged innovation, marketing diversity, and international investment.

- Revenue Generation: The market reported $2.4 billion in gaming revenue for fiscal year 2023–2024, with 1.3 million active player accounts during Q4. Ontario’s model has outperformed expectations, demonstrating the commercial viability of a well-regulated, competitive framework.

- Geographical Limitations: Players may only access licensed platforms while physically located within Ontario's boundaries. Geolocation and identity verification technologies are mandatory to enforce this rule.

- Mandatory Registration: All operators must register with the AGCO to ensure compliance with provincial standards. Online casino licensing criteria emphasize consumer protection, anti-money laundering measures, and responsible gambling safeguards. Online casino activity has seen significant growth since regulation, with the open market attracting major global operators and substantial investment. This model is now seen as a benchmark for potential regulation in other provinces exploring market liberalization.

Loto-Québec Regulations

In stark contrast to Ontario's approach, Quebec maintains a government monopoly model through Loto-Québec, a crown corporation established in 1969. This organization oversees all forms of gambling within the province, including the Espacejeux online platform, which operates as the exclusive legal channel for internet-based wagering. Key aspects of Quebec's regulatory approach include:

- Government Monopoly: Loto-Québec is the sole authorized provider of online gambling services. Private operators are prohibited from entering the market, preserving centralized control over content, marketing, and platform management.

- Revenue Allocation: Profits generated through Loto-Québec directly support provincial programs and services, including healthcare, education, and infrastructure. This ensures gambling proceeds are reinvested for public benefit rather than private profit.

- Integrated Responsible Gambling: Centralized oversight facilitates the province-wide implementation of responsible gambling measures such as self-exclusion tools, spending limits, and educational campaigns under the "Jeu responsable" program.

- Lower Age Requirement: Quebec permits gambling at age 18, compared to Ontario's minimum age of 19. This aligns with the province's broader age-of-majority policies and contributes to earlier market engagement. Quebec's gambling participation rate of 69.1% exceeds the national average, suggesting that the monopoly model has not discouraged consumer interest. Instead, it demonstrates that a well-managed public system can coexist with high engagement, while retaining strong regulatory safeguards and societal returns.

Types of Regulations Across Canadian Regions

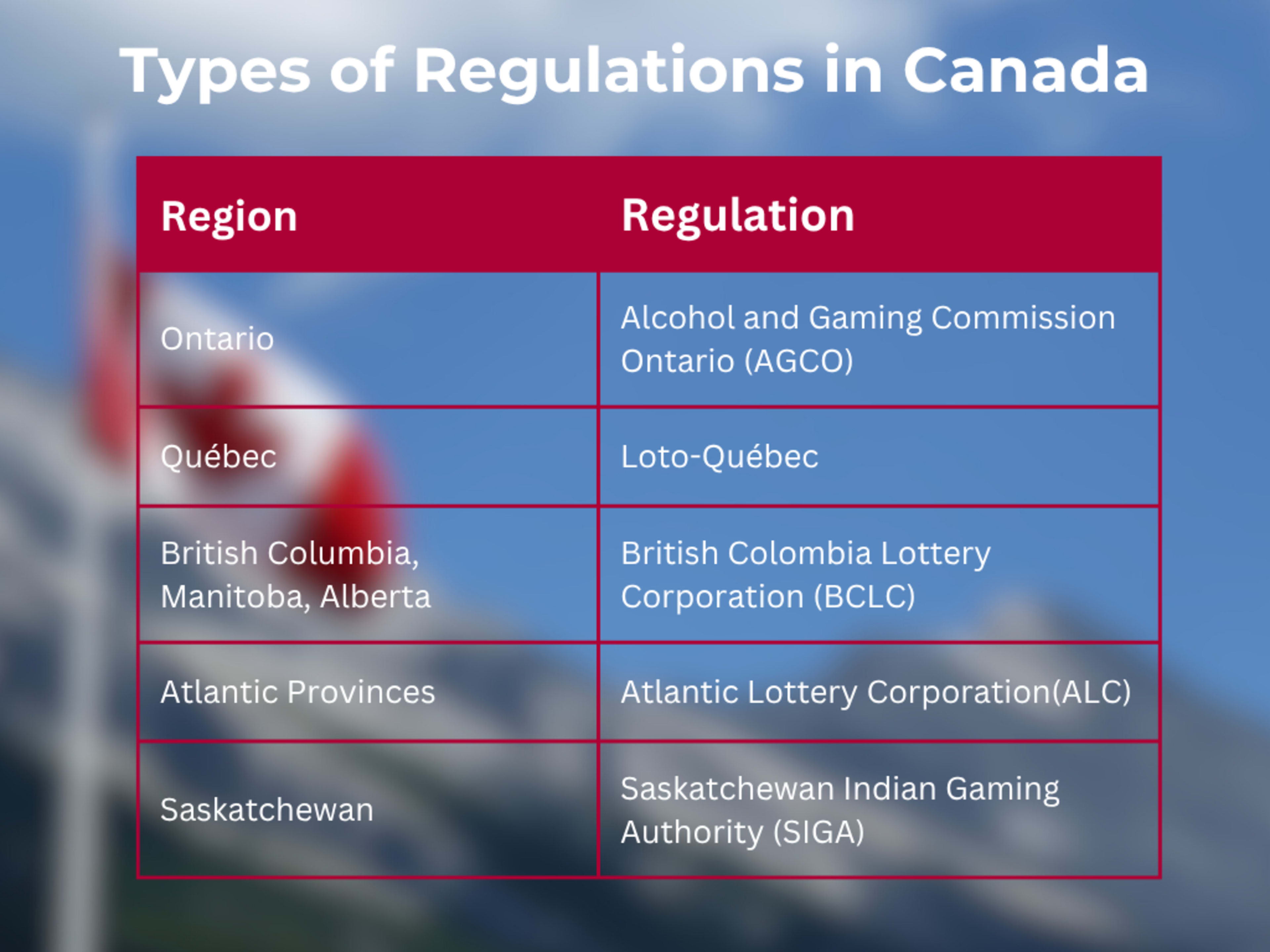

While Ontario and Quebec represent contrasting regulatory philosophies, other provinces have developed their own approaches, according to NCFA Canada:

Saskatchewan

Saskatchewan combines limited provincial licensing with robust First Nations involvement, particularly through the Saskatchewan Indian Gaming Authority (SIGA). In 2022, the province launched a regulated online option in partnership with BCLC. This emerging hybrid model supports both economic development and cultural autonomy while responding to growing demand for legal digital gambling.

Atlantic Provinces

The Atlantic Provinces maintain conservative gambling environments, focusing on land-based casinos and VLTs. Online options are limited to the Atlantic Lottery Corporation, which offers fewer games and less variety than national competitors. Regulatory priorities center on minimizing harm and ensuring that gambling proceeds benefit public services, making the region cautious but socially accountable.

British Columbia, Manitoba, and Alberta

These provinces use government-run platforms like PlayNow, operated by the BCLC, to regulate online gambling. The model limits private competition but ensures strong oversight, consumer protection, and public revenue reinvestment. Though less diverse than open markets, the approach emphasizes stability and control, with consistent responsible gambling tools integrated across all operations.

The Territories

Yukon, Northwest Territories, and Nunavut have minimal gambling infrastructure due to small populations and geographic isolation. No regulated online platforms currently exist, leaving residents with few legal options. Most gambling activity is informal or occurs through unregulated offshore sites, highlighting the need for future regulatory development and digital access.

How iGaming Regulations Affect Canadian Players

iGaming regulations play a pivotal role in shaping the experience of Canadian online casino players. In provinces like Ontario, where the industry has been formally regulated, players benefit from increased choice, better consumer protections, and access to reputable international operators. Licensed platforms must meet strict standards for fairness, security, and responsible gambling, which helps build player trust and reduce risks associated with unregulated sites.

On the other hand, in provinces with limited or centralized iGaming frameworks—such as Quebec—players may find fewer options but more consistent oversight, often tied to government-run platforms. These regulatory differences directly impact how easily players can access various online casino games, the quality of those platforms, and the safeguards in place to protect them. As more provinces consider regulatory reform, Canadian players could see broader access and higher standards across the board, making regulation not just a legal issue but a key factor in shaping the overall quality of online casino platform play.

What are the differences between AGCO & Loto-Québec?

The contrast between Ontario's open market and Quebec's crown corporation model highlights fundamental differences in regulatory philosophy:

| Aspect | Ontario (AGCO) | Quebec (Loto-Québec) |

|---|---|---|

| Market Structure | Competitive, multi-operator | Government monopoly |

| Licensing Approach | Multiple private licenses | Single crown corporation |

| Revenue Model | Tax on operator revenue | Direct government profits |

| Player Accounts | 1.3 million active (Q4 2023-24) | Not publicly disclosed |

| Age Requirement | 19 years | 18 years |

| Regulatory Focus | Operator compliance, player protection | Centralized control, public benefit |

Conclusion

Ontario and Quebec have taken divergent yet effective paths in regulating gambling. Ontario’s open-market strategy has attracted global operators, spurred competition, and expanded consumer choice. In contrast, Quebec’s centralized model prioritizes consistent oversight and channels revenue into public services.

Both systems are proving viable, with Ontario seeing growth in online casino activity and Quebec maintaining steady participation. Rather than pointing to a single "best" model, these approaches reflect differing provincial priorities—and both may hold lessons for future regulatory frameworks.

Considering the continued growth of Canada’s iGaming industry, the strengths of each system could inspire hybrid models elsewhere. For now, AGCO and Loto-Québec remain the leading examples of how different regulatory philosophies can coexist and succeed in shaping the future of gambling.